Quote:

We live in interesting times!

Will you take a paycut to save the company, part 3

I never thought there would be a part 3 to this.

A few days after the voting was officially over, my manager mentioned in a group lunch that he was surprised by my group's response, but he did not elaborate. He also said the voting period was been extended.

A few days later, we received an email that mentioned that 80% "responded positively". I thought that was the end of it.

A week later, our section manager called an "emergency" meeting to appeal to us once again. He said Singapore's figures were "substantially lower", and the management was very concerned.

I doubt people will change their mind. I don't think people believe that there are no consequences (the official claim), but look at it this way:

- 5% cut is 1 to 3 normal pay increments, so even if you are skipped for a few rounds, you are still ahead.

- There is no guarantee of no WFR.

- The Singapore Government is already subsidizing 12% of the CPF (up to $2.5k).

- Company appears to be doing well, judging by its stock price (at local high).

- The grunts (that's us) have been "suffering" for years.

Let's see what happens after this deadline. Will there be another round of appeal? If there is, I may be inclined to change my vote. Always go with the majority, I say. Let's die together!

Money first in Singapore

News: Where money holds sway

The large salaries paid to the elite is pushing many Singaporeans towards an unhealthy chase for the dollar.

THE trial of a high-living Buddhist monk who owns three properties and loves luxurious cars has shown how far Singapore has fallen under a money culture.

It is the latest of an ongoing debate whether this affluent city is over-paying its leaders in government, big business, big charities and religion.

Even priests and monks, who should be the last people to be involved, are not spared, the latest being one of Singapore's top Buddhist monks.

He is Venerable Shi Ming Yi, who ran a popular and successful Buddhist hospital and medical centre for the poor.

As CEO and chairman of Ren Ci Hospital and Medicare Centre with assets of S$47mil (RM112mil) , largely on public donations, he was paid a whopping annual salary of S$192,000 (RM461,000).

The saffron-robed monk, aged 47, is facing charges over an unauthorised loan from Ren Ci's coffers to his ex-personal aide.

He is accused of embezzlement and fraud, which are serious charges. But for a monk who has taken the vow of worldly abstinence, it is more like a bombshell; and for Buddhist followers, too.

The furore is even being played out outside the court-room, focused on his CEO-type salary that allowed him to live a lavish lifestyle, which critics say is unbecoming of a monk.

He had spent large amounts on branded goods like Montblanc and Louis Vuitton and stays at luxury hotels such as St Regis and The Regent, charged to credit cards.

Singaporeans have learned that Rev. Ming Yi owns three properties in the posh Orchard area as well as an expensive car (including a BMW in Australia two years ago.).

"All this is totally against Buddha's teaching," a critic exclaimed.

Another blogged: "Any monk that takes money as his private or personal income should be de-robed. Monks have taken a vow to give up material wants except for basic needs."

The Christian faith, too, is not excluded by society's grip of the money culture.

The majority of religious leaders of all denominations live frugally on moderate incomes.

The big organisations involved in large fund-raising could provide the exception.

A few are paid like CEOs because their efforts rake in large amounts of money from followers.

One of the richest is the New Creation Church, known for its fund-raising abilities, and was reported to have paid one of its leaders more than S$500,000 (RM1.2mil) last year.

The church had an income of S$55.4mil (RM133mil) and total assets of S$143.36mil (RM344mil) last year.

In just one day alone it pulled in S$18mil (RM43mil) for the building of its new premises.

Singaporeans are reminded of the notorious National Kidney Foundation charity scandal four years ago caused by its brilliant fund-raising CEO.

T.T. Durai was the very person who had helped it grow into a S$260mil (RM625mil) charity to provide subsidised dialysis treatment for needy patients.

Durai's salary of S$600,000 (RM1.4mil), which was hidden from the public, was considered excessive by many of its two million donors.

He lost the job in 2005 when he was found to have spent the charity's funds on luxury items (including a gold tap for an office) for personal use. He also gave misleading information to lure more people to contribute.

Recently, a public outcry arose when government-controlled Capitaland, South-East Asia's biggest property company, gave its CEO Liew Mun Leong S$20.52mil (RM49mil) for 2007's enlarged profit.

The timing was terrible; the company's profits were reeling.

The debate is whether quality leaders in charity and religion — and politics, too — should be paid similar to a top executive of a profitable private venture.

The difference, of course, is that the money is raised from the public, based on trust that it is for a collective purpose.

Rev. Ming Yi's defenders, however, argue although he is a monk, where a high salary appears ridiculous, he is also chief executive of a large, well-run, hospital and medical centre.

"So what's wrong about his high pay?" one asked.

Others say today's Buddhist monkhood, like others, is different from ancient times when monks lived an austere life within high walls.

Rev. Ming Yi told the court that "we live in a modern world ... no longer like what it was in the past".

Asked to elaborate, he added: "If people earn more, they will spend more.

Many religious people, not just myself, are very different now."

Unfortunately not many people's expectations have changed.

Most Singaporeans believe that when they donate money to a religious organisation or a charity, it is aimed at helping people (or troubled souls) in need, not to provide comfort for a few leaders.

The debate about Singapore's spreading money culture - with a per capita GDP of US$48,900 (RM175,000) - has intensified since the economy plunged and sent many workers into hardship.

People have become more sensitive about the ruling elite — whether in the government, civil service or a large corporation — being paid excessively more than the average, middle class person.

Ironically, the unpopular elite pay policy is pushing many competitive Singaporeans towards giving wealth accumulation top priority.

People are lured to an unhealthy chase for the dollar.

"They see materialism as a god. Money can do anything, even deciding what is right or wrong," remarked a semi-retired professional.

On the same day that Rev. Ming Yi was testifying, the manager of a shipping firm was fined S$1,200 for vandalising his neighbour's flat.

The amount did not faze the apparently well-to-do man, who told a reporter: "After all, I can afford to pay. I spend S$4,000 on karaoke in one night. What's S$1,200?"

Who says money doesn't talk?

I'm surprised the followers haven't lost their faith yet.

A comment on the new US presidency

This administration has such mastery over press manipulation that it can rightly be accused of Axis-power style propaganda.

The Obama administration claims it is halving the deficit — while in the very process of doubling it.

It talks about bi-partisanship — while executing procedural maneuvers to cut off Congressional debate.

It talks about restraint — while rushing a trillion dollar package through Congress in three days.

And now, it talks about budget cuts — which amount to 1/35 thousandth of its budget.

Is this shrewdness on their part — or is in contempt for American citizens?

Well said. Obama speaks well, but his actions don't match his words.

A matter of confidence

News: Insider Selling Jumps to Highest Level Since 2007

Executives and insiders at U.S. companies are taking advantage of the steepest stock market gains since 1938 to unload shares at the fastest pace since the start of the bear market.

Gap Inc.'s founding family sold $45 million of shares in the largest U.S. clothing retailer this month, according to Securities and Exchange Commission filings compiled by Bloomberg. Daniel Warmenhoven, the chief executive officer at NetApp Inc., liquidated the most stock of the storage-computer maker in more than six years. Sales by the co-founders of Bed Bath & Beyond Inc. were the highest since at least 2001.

While the Standard & Poor's 500 Index climbed 28 percent from a 12-year low on March 9, CEOs, directors and senior officers at U.S. companies sold $353 million of equities this month, or 8.3 times more than they bought, data compiled by Washington Service, a Bethesda, Maryland-based research firm, show. That's a warning sign because insiders usually have more information about their companies' prospects than anyone else, according to William Stone at PNC Financial Services Group Inc.

"They should know more than outsiders would, so you could take it as a signal that there is something wrong if they're selling," said Stone, chief investment strategist at PNC's wealth management unit, which oversees $110 billion in Philadelphia. "Whether it's a sustainable rebound is still in question. I'd prefer they were buying."

Insiders Sell

Insiders from New York Stock Exchange-listed companies sold $8.32 worth of stock for every dollar bought in the first three weeks of April, according to Washington Service, which analyzes stock transactions of corporate insiders for more than 500 institutional clients.

That's the fastest rate of selling since October 2007, when U.S. stocks peaked and the 17-month bear market that wiped out more than half the market value of U.S. companies began. The $42.5 million in insider purchases through April 20 would represent the smallest amount for a full month since July 1992, data going back more than 20 years show. That drop preceded a 2.4 percent slide in the S&P 500 in August 1992.

The index rose 1.7 percent to 866.23 today after the Federal Reserve said most banks that underwent stress tests hold enough capital and companies from Ford Motor Co. to American Express Co. posted better-than-estimated results.

Looking Forward

The S&P 500 has jumped 28 percent in 33 trading days, the sharpest rally since the 1930s, on speculation the longest recession since World War II will soon end.

Stocks rebounded as President Barack Obama outlined a $787 billion package of spending and tax cuts to stimulate growth, the Treasury unveiled plans to finance as much as $1 trillion in purchases of banks' distressed assets and the Fed pledged to buy more than $1 trillion of Treasuries and bonds backed by mortgages to drive down interest rates.

With corporate America stuck in its seventh straight quarter of earnings decreases, the longest in seven decades, executives may have become too cautious, said Penn Capital Management's Eric Green.

Investors are looking to the final quarter of the year, when S&P 500 companies will increase operating income by 71 percent, according to analyst estimates compiled by Bloomberg. They forecast profits will fall 33 percent in the second quarter and 21 percent in the third.

"Things are a lot better than they were," said Green, director of research at Penn Capital, which oversees $3 billion in Cherry Hill, New Jersey. Recent history also shows that "insiders have been wrong," he said.

Confidence Game

Jeffrey Immelt, CEO of General Electric Co., purchased 50,000 shares at prices from $16.41 to $16.45 on Nov. 13, when the stock closed at $16.86. The shares have since fallen 28 percent after the Fairfield, Connecticut-based company reduced its dividend for the first time since 1938 and lost the AAA credit rating from S&P that it held for more than 50 years.

Insiders of consumer and technology companies have been selling the most stock relative to the amount they purchased this month, data compiled by Washington Service show.

John Fisher, Robert Fisher and William Fisher, whose parents Donald and Doris Fisher founded San Francisco-based Gap in 1969, sold a combined 2.99 million shares at between $15.11 and $15.36 a share on April 3 and April 17, SEC filings show. Gap rebounded 55 percent from its low on March 6. The stock gained 1.1 percent since the Fishers' last sale.

Reasons to Sell

Gap spokesman Bill Chandler said that "from time to time, based upon the advice of financial advisers, the members of the Fisher family will decide to sell stock."

Warren Eisenberg and Leonard Feinstein, who founded Union, New Jersey-based Bed Bath & Beyond in 1971, sold 1.05 million and 1.1 million shares at $30.90 apiece on April 9, the most since at least December 2001, the filings show.

The offerings came one day after Bed Bath & Beyond surged 24 percent, the biggest advance in nine years, on a smaller than estimated decline in fourth-quarter profit. Spokesman Ken Frankel said Eisenberg and Feinstein, who currently serve as co- chairmen of the largest U.S. home-furnishings retailer, sold for "estate-planning purposes and diversification."

At NetApp, Warmenhoven sold 1.25 million shares, the most since at least 2002, for about $21.3 million between April 3 and April 21 at prices from $16.10 to $18.10 a share, the SEC filings show. Shares of the Sunnyvale, California-based company, up 49 percent from $12.52 on the March 9 stock market low, gained 3.3 percent since then.

Moving On

Warmenhoven sold shares he received from exercising stock options that were due to expire next month, according to an e- mailed response by Lindsey Smith, a spokeswoman for NetApp. He reaped a profit of about $7.3 million selling the shares at an average price of $17.08 apiece, based on the conversion price of $11.25 for options he held, the data show.

"They're going to say, 'Thank you very much,' and move on to cash or something else," said David W. James, who helps manage about $2 billion at James Investment Research Inc. in Xenia, Ohio. "This is not a situation that suggests to us we're seeing an economic recovery."

Hmm...

China is diversifying

News: China admits to building up stockpile of gold

China revealed on Friday that it had secretly raised its gold reserves by three-quarters since 2003, increasing its holdings to 1,054 tonnes - or a pot worth about US$30.9-billion - and confirming years of speculation it had been buying.

Hu Xiaolian, head of the State Administration of Foreign Exchange, told Xinhua news agency in an interview that the country's reserves had risen by 454 tonnes from 600 tonnes since 2003, when China last adjusted its state gold reserves figure.

The confirmation of its surreptitious stockpiling is likely to fuel market talk about Beijing's ability to buy secretly and its ambitions for spending its nearly US$2-trillion pile of savings. And not just in gold: copper and other metals markets are booming thanks to China's barely-visible hand.

Speculation has gathered speed over the last year, since the tumbling dollar has threatened to weaken China's buying power - and give it yet more reason to diversify into gold, oil and metals.

Gold prices jumped on the news of Chinese buying and were up more than 1% on the day at US$912.05 an ounce at 0715 GMT. By a Reuters calculation, China's holding of gold would be worth around US$30.9-billion at current prices.

That accounts for only about 1.6% of China's total foreign exchange holdings and is little more than one-tenth of the value of the U.S. gold reserve, the world's biggest. It also means gold has slipped as a share of China's total reserves from about 2%, based on end-2003 prices.

Only six countries hold more than 1,000 tonnes, and China is ranked fifth, having leap-frogged Switzerland, Japan and the Netherlands with its announcement.

However, the International Monetary Fund and the SPDR Gold Trust exchange traded fund are even bigger, leaving China with the world's seventh-biggest pot of gold.

Several gold market participants said they thought China had bought on the international market, helping to absorb hundreds of tonnes sold off by central banks and the International Monetary Fund in recent years.

"China has been buying via government channels from South Africa, Russia and South America," said Ellison Chu, director of precious metals at Standard Bank in Hong Kong.

But Hu said the increase in China's stocks was achieved by buying on the domestic market and from domestic producers.

China is the world's largest gold producer and does not permit exports of gold ingots, only jewellery, leaving plentiful supplies for the domestic market.

China produced 282 tonnes of gold last year, meaning the state bought around one quarter of domestic production, assuming 454 tonnes increase in state purchases were spread out over the six years since China last reported a change in its holdings.

Despite the rumours, buying by the state was partially obscured by soaring demand for gold as an investment, especially after the bursting of the Shanghai stock market bubble last year.

Investment demand in China rose to 68.9 tonnes from 25.6 tonnes in 2007. But that was still less than one third of retail demand in India, where total bullion consumption topped 660 tonnes last year.

Hu said China recently reported the change in its gold holdings to the International Monetary Fund and would include the latest change in central bank reports and balance of payment statistics.

She did not say when China notified the IMF.

Although gold rose after Hu's comments were published, the price move was not a huge one for the highly liquid market. Prices had jumped by US$13 in the space of an hour on Thursday.

Gold market participants said the news signalled likely further buying by China.

"The comments indicate that China will buy more gold as reserve to improve its foreign reserve portfolio. This is a trend," said Yao Haiqiao, president of Longgold Asset Management.

Hou Huimin, vice general secretary of the China Gold Association, said China should build its reserves to 5,000 tonnes.

"It's not a matter of a few hundred, or 1,000 tonnes. China should hold more because of its new international status, and because of the financial crisis," he said.

"The financial crisis means the U.S. dollar value is changing fast, and it may retreat from being the international reserve currency. If that happens, whoever holds gold will be at an advantage."

The European Central Bank recommends its member banks hold 15% of their reserves in gold, but among Asian nations the percentage is far smaller, said Albert Cheng, World Gold Council managing director for the far east.

Mankind just cannot get away from gold. Gold does not have an intrinsic value (you can't eat it, for example). Gold has value because everyone agrees it has value — it is very suitable for trading. Ultimately, people have more confidence in a physical item than fiat currency.

Why so many variants?

Recently, a friend was looking at the Macross 1/60 Destroids and was upset that the manufacturer, Yamato, came out with 4 variants per toy:

- Cartoon color

- Cartoon, weathered

- Olive drab

- Olive drab, weathered

(The weathered editions are limited editions. Apparently, they are used to get rid of excess stock!)

I am not surprised. The destroids are a very niche market, much more niche than the transformable VF planes. Perhaps the demand was even less than one minimum run! (Or more likely, to break even.)

What to do? Instead of 10,000 units, break them up into four 2,500 units. The hardcore collectors will then collect all four, helping with the sales. The more "realistic" olive drab color will appeal to the BattleTech group too.

Speaking of the planes, the VF-1 Valkyrie is really a cashcow for Yamato. There are six models: VF-1A, VF-1D, VF-1J, VF-1S, VT-1 and VE-1. The 1A, 1J and 1S are 100% identical, except for the head! The 1D shares 95% of the parts (it's a two seater) and the VT-1 and VE-1 perhaps 80%.

There are several color schemes per model. For example, VF-1A has six color schemes:

- one with red strips

- one with blue strips

- one with green strips

- one with blue panels

- one with brown panels

- "cannon fodder" (generic fighter)

Yamato also releases several VF-1 with non-canon colors.

If this is not enough, Yamato has issued the VF-1 three times. First, it came out with the 1/60 scale. There were some shortcomings, but it was much better than the old 80s edition, so fans still bought it. Then it switched to the 1/48. Finally, it switched back to 1/60, calling them version 2.0.

Unlike many collectors, I don't see the point of buying every single plane, even though they are canon. These are very expensive (and quite fragile) toys! I have two 1/60 v1 and two 1/48 VFs. That's enough for me.

No tax revenue, got to borrow

News: Soaring U.S. Budget Deficit Will Mean Billions in Bond Sales

Millions of lost jobs mean billions in lost tax revenue for the U.S. government, and billions in additional Treasury debt to fund a federal budget deficit that may soar to more than four times last year's record $454.7 billion.

Employers cut 3.7 million positions from their payrolls in the six months since the fiscal year began Oct. 1, and the unemployment rate reached a 25-year high of 8.5 percent in March. That suggests receipts for April -- the biggest month for tax collection -- are likely to come in well below April 2008, analysts said.

With spending on unemployment insurance and other safety- net programs rising, the deficit is already at a record $956.8 billion six months into the fiscal year. To help close that gap, the Treasury Department has more than quadrupled borrowing, pushing the government deeper into debt.

"Tax receipts are just collapsing," said Chris Ahrens, head of interest-rate strategy at UBS Securities LLC in Stamford, Connecticut, one of 16 primary dealers required to bid at Treasury auctions. The need to sell more debt "is a big issue in the Treasury market and it is ongoing. The surging budget deficit is the primary cause."

The government will have to sell $2.4 trillion in new bills, notes and bonds in fiscal 2009, according to UBS. From October through December, the Treasury sold a record $569 billion, up from $82 billion in the same period a year earlier, and auctioned another $493 billion in the last quarter, up from $156 billion. That helps to make up for the drop in tax receipts, pay for the rise in spending and refinance maturing debt. Along with the principal, the sales add additional interest costs to the deficit for years to come.

Unemployment Benefits

At the same time, government spending has climbed 33 percent in the fiscal year through March, as relief programs such as unemployment benefits expand. Labor Department expenditures have more than doubled to $52.7 billion and payments by the Department of Health and Human Services have risen by $40.6 billion, or 12 percent. Spending by the Agriculture Department, which runs the food-stamp program, is 18 percent higher, or $9.9 billion more than in the same period a year ago.

These increases will contribute to a record federal budget deficit this fiscal year. On March 20, the Congressional Budget Office forecast the shortfall will reach $1.85 trillion, dwarfing the previous peak. UBS estimates a budget deficit of $1.65 trillion, Ahrens said.

Plummeting Receipts

Rising unemployment and lower consumer spending helped drag income-tax receipts from individuals and small businesses down 15 percent in fiscal 2009 through March, compared with a year earlier. Data due in May will likely show that the recession curbed estimated-tax payments in the first quarter, while the drop in financial markets caused capital gains to shrink.

With the tax cuts from President Barack Obama's stimulus package also taking effect in April, "that combination is going to give you weak tax revenues," said Douglas Lee, chief economist at Economics From Washington, an independent consulting firm in Potomac, Maryland.

From the start of the fiscal year through March, personal income-tax payments fell to $429.7 billion from $503.5 billion in the year-earlier period, according to Treasury budget statistics. That's the first such drop since 2003, according to department records.

"There's been a huge hit, not just to income but to wealth," said Ethan Harris, co-head of U.S. economic research at Barclays Capital Inc. in New York. "The economy did not turn in the first quarter of the year." The numbers "are worse than most of us would have expected coming into the tax season."

Lower Earnings, Higher Refunds

The federal government is also losing revenue from corporate tax receipts, which have fallen 57 percent from the first six months of fiscal 2008. Not only are companies earning less -- and paying less in taxes -- they are getting more in refunds.

Obama's economic-stimulus package included a provision allowing small businesses with losses in 2008 to carry back those losses for five years rather than two, so companies can claim refunds against taxes paid in the past. Business refunds in January through March of this year were $40.4 billion, almost double the $22.3 billion of a year ago.

Personal income-tax refunds are also higher than last year, up 11 percent to $207.8 billion. That may be because people who pay estimated quarterly taxes based their estimates on 2007 earnings, and overpaid as the economy collapsed in 2008, Lee said.

Close the Gap

States and cities are also being hit hard by unemployment's effect on tax revenue. The 23,300 Wall Street jobs that disappeared in the year through February helped blow a $16 billion hole in New York state's budget. State officials are trying to close the gap by raising taxes, which will likely restrain spending and slow recovery.

The attack on bonuses led by members of Congress also hurts. As payments are scaled back or eliminated, tax revenue falls. It's not just a problem for New York: Individual tax receipts were 4.5 percent less than forecast in Minnesota during February and March.

"While lower-than-expected withholding-tax receipts are always a matter of concern, this shortfall appears to be due to lower-than-projected bonus payments," the Minnesota Management and Budget office said in its April Economic Update.

At the federal level, concern over the budget deficit extends beyond this year's "disaster," Harris said. Social Security and Medicare costs are also rising as baby boomers age, and the Obama administration has a number of new programs beyond stimulus -- including revamping health care -- that it wants to spend money on.

"It's going to be a structural issue," Harris said. "You have a Congress that's lost its fear of deficits, so it's still going to be hard to turn the deficit around once the economy and tax receipts have recovered."

Challenging times. It would be interesting to see the effect on the bond market. Specifically, when will the buyers stop buying? That would be a very interesting moment. (Having to raise interest rates to attract buyers is not a good thing too. Having borrowed so much, it is to the advantage of US to keep interest rates low.)

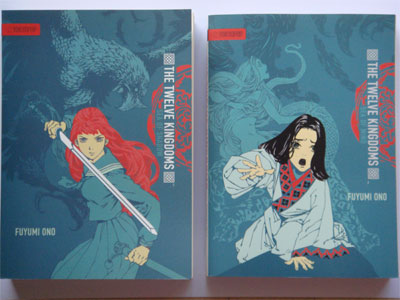

The 12K novels

I like the show Twelve Kingdoms very much. Some parts are quite slow (especially the start) and the animation is lackluster, but the story transcends its production flaws.

The story is very intriguing because it brings you into an alternate world. If you buy the story, you'll be hooked as you try to uncover how the alternate world works.

Twelve Kingdoms is based on novels of the same name. There are seven novels, around four of which are animated. For the time being, it doesn't look like there will be new animation nor novels.

For a long time, the novels don't mean anything to me. After all, they are in Japanese. And Japanese is as greek to me as greek is to a Japanese. TokyoPop has been translating them to English since 2007, at a rate of one book per year! In the first year, they will release the hardcover volume, then they will release the paperback volume exactly one year later. As of now, there are two paperbacks (the first two volumes) and one hardcover volume.

The hardcover version is too expensive for me. Amazon wants US$12.23 for it (not too bad), but Kino wants S$32+ and Borders S$36+! The local bookstores usually offer the books around 2x MSRP (US$17.99). The paperback version is still not too bad. Amazon wants US$8.99, Kino S$13+ and Borders S$18+.

There is one big reason why I hesitated to get the books: there are free translations of the novels online, copyright violations aside. Volumes 1, 2, 4, 6 and partially 7 are available. Some people spent the time and effort to translate the novels on their own. The translations are pretty good, in my opinion.

The second reason is that there is no guarantee that TokyoPop will finish the entire series. Anime is a niche market in the US, mangas even more so. I presume translated Japanese novels are even more niche.

A third reason is that the novels are said to have been fully translated to Chinese! I would prefer to read the Chinese verison if it's available. My impression is that Japanese translates rather well to Chinese, so the original meanings and styles are retained.

Still, faced with the books before me, I decided to pick them up after all. Take it as a vote for TokyoPop to continue its translations.

A new lease of life for my shoes

My shoes have reached its EOL, but I passed by a clobber shop while wandering in a mall, and I thought, "why not?".

I was rather surprised to find a clobber shop, of all places, in a mall! I know clobbers must exist in Singapore, but I don't know where to find them (other than makeshift "pushcarts" in the heartlands).

The soles have started to detach from the shoes, so I asked if they can be glued back. However, the clobber said the soles should be replaced and then the shoes can be used for another few years.

I was sold on the idea. I watched a recent news that men's shoes can be worn for ten years before they finally wear out. I'll be happy if my shoes can last another three years.

Of course, you can say that the clobber would recommend a more expensive solution. I agree. That's something to keep in mind when asking vested specialists for advice. Still, it's a win-win situation if the shoes actually last for years.

It was much more expensive than what I had expected to pay for gluing back the soles.

Downgraded my website

I'm paying $150 for 800 MB space and 20 GB (?) monthly bandwidth for my website. I'm paying another $15 for the domain name.

My web hosting company offers monthly specials every month, so when my site is up for its yearly renewal, I found a suitable plan among the specials: 1 GB space, 10 GB monthly bandwidth for just $100.

However, I did not switch to it as it involves moving to a slower server (and a $30 migration charge). In the end, I opted for a normal $120 plan that offers 1 GB space and 20 GB monthly bandwidth.

I save $30 and gain 200 MB more space! (Not that I need the space right now.)

I am really underutilizing my website. It has so much to offer: PHP, MySQL, forums, sub-domains. I'm not using it to its full potential at all.

The analysts and the market

I find it quite ironic. When the market turned around, all the analysts say it's a bear rally. The market kept going up, as if to spite them. The market is still on an uptrend.

The market will go down when the Singapore Government says the economy is recovering. The Singapore Government has an uncanny ability to be opposite of the market. By the time they give their analysis, the situation has totally changed.

I also feel that the fundamentals have not changed. The big US banks are bankrupted (probably) and the US Government is still taking the approach of spending money that it doesn't have to try to spur the economy.

However, this is not your grandfather's recession. The US consumers are overleveraged (credit cards) and underwater (housing mortgage). I don't see how the economy can recover in the short term, especially when the US Government is refusing to recognize the losses.

More rope to hang yourself

News: Banks lure big earners with more credit

HIGH net worth individuals will be enjoying increased spending power in the months to come as banks take advantage of relaxed rules on credit card limits.

Standard Chartered is already offering well-off customers a card with considerably higher credit limits, and Citibank is promising something similar 'soon'.

Previous limits had been set at two times the monthly income - both for credit cards and unsecured bank loans - and applied to people earning at least $30,000 a year.

But these were freed up on March 1 under changes to the credit card provisions of the Banking Act.

One change exempts credit card issuers from limits when issuing cards to people earning at least $120,000 a year or those with net personal assets of at least $2 million.

This means banks can extend any amount of credit they choose to their customers in top income brackets.

StanChart has taken the lead with its new Visa Infinite credit card that was launched on March 24.

The card provides customers earning more than $120,000 a year with a credit limit of up to 10 times their monthly income, as well as other rewards based on the customer's total relationship with the bank.

It caters to the bank's priority banking customers, which comprise a significant portion of its customer base.

Said Ms Ngo Min Ying, StanChart's general manager for premium banking: 'We estimate that out of the pool of customers that have reported income, about two out of every five of them have an annual income of $120,000 or more.'

Citibank will increase credit limits for high earners 'soon'.

'We welcome the revised rules, as it extends more flexibility and choice to this group of borrowers, who have varied credit needs that differ from the average income earner,' said Ms Alice Fok, Citibank Singapore's head of core cards.

The bank said it has existing products tailored to the needs of these customers, so it does not plan to introduce any new products right now.

Several other banks told The Straits Times they would watch for opportunities arising from the relaxed credit rules.

Royal Bank of Scotland's (RBS) head of consumer finance here, Ms Pamela Tan, said: 'We will certainly be taking advantage of it to tailor competitive and innovative new offerings.'

The Monetary Authority of Singapore said in a 2007 consultation paper that one reason for the credit limit amendment was that well-off consumers generally require less protection under the Government's social policy rules on credit.

'From the historical default data of major card issuers in Singapore, we observed that the percentage of serious defaults among cardholders in this income group is generally very low,' it wrote.

People on this level of pay form the top 5 per cent of income earners in Singapore, based on the General Household Survey of 2005.

Portfolio manager Jimmy Lim, 32, a priority banking customer at StanChart, is happy with the changes.

'This is a good move as it gives me more flexibility, and I don't need to go through the hassle of asking for a temporary credit increase when I want to purchase a big-ticket item like a watch or a holiday with the family,' he said.

Mr Leong Sze Hian, president of the Society of Financial Service Professionals, takes a more cautious view and believes relaxed credit limits are a 'double-edged sword' in these times.

'Now in this recession, even a lot of higher income earners may need credit to solve their cash flow problems, so this may come in handy,' he said.

But he added that 'since limits have been raised substantially, more people may fall into debt, and this will have undesirable consequences going forward'.

People with cash flow problems and no available credit would typically be more prudent and tighten their belts, but now there is the danger that they may just keep spending.

Amendments made to the Bankruptcy Act in January could be helpful in this area.

The Debt Repayment Scheme will allow wage-earning debtors who owe not more than $100,000 to avoid bankruptcy. Instead, they will have to use part of their monthly incomes to repay their debts.

If I earn $30k/year, my credit limit is $5k/card. If I earn $120k/year, my limit is $100k/card!

I suspect the bank is hoping these people will borrow to their limit and then roll over their balance. The bank will earn $24k/year in interest then.

Good money for the bank, not so good for the person. If you used to earn $120k, now you only earn $96k.

Model shoot

News: Want to be a bikini model?

Young and eager, many girls are readily posing for male photographers for small fee, even free

The pay could be as little as $15 an hour for a two-hour photoshoot.

But there is no shortage of women agreeing to pose - sometimes in lingerie or bikini - for mostly male photography buffs, say organisers.

The 'models' are mostly teens, fresh-faced and eager to build up their portfolios. Some even agree to pose for free.

Indeed, a community of at least 30 active models has sprouted over the past year. They take part in weekend photoshoots advertised mainly on online photography forum Clubsnap.

The outings range from outdoors fashion shoots to those where the models pose in bikinis on Sentosa's beaches or in lingerie in studios and hotel rooms.

A new model can, on average, earn about $30 an hour for a two-hour shoot with a group of four to 12 photographers. More seasoned ones can get $200 an hour.

Some girls waive the fee in exchange for a CD of the photos from the photographer.

On any given weekend, there are six to 10 photoshoots advertised on Clubsnap, and others which are held privately. Amateur and hobbyist photographers, mostly males aged between 18 and 60, are charged $18 to $250 each.

As many as three models are hired for each shoot, ensuring a 4:1 or 6:1 photographer-to-model ratio that is rated ideal. Private one-on-one photo sessions can be arranged by paying a little more.

Mr Mike Tan, 35, a professional photographer who has been organising shoots for the past eight years, said the models are getting younger. 'In the old days, they would be about 18 to 25, now they are usually 14 to 22.'

He gets as many as 50 e-mail messages daily from girls hoping to launch their modelling careers. Some indicate they are open to posing in lingerie or swimwear.

He also 'talent-spots pretty girls' through their blogs. He said most readily agree to taking part in shoots or are at least piqued enough to discuss them over coffee.

There are also organisers as young as Mr Mervin Lee, 19, a music student at Nanyang Academy of Fine Arts. He has no problems sourcing for models. 'I quote a price - you take it or leave it. There are many others to choose from,' said Mr Lee, who has been setting up shoots since January.

He first took part in such events as a photographer but switched to organising them, lured by the chance to earn cash.

'It's also a very social part-time occupation,' said Mr Lee, who once earned $200 from a single shoot. He has more than 20 models whom he engages for outdoor fashion shoots.

At photoshoots, participants can chat with the models or suggest poses but are not permitted to touch them.

Still, Ms Fiona Lee, owner of Fiona's Models, Talents And Events Management, would rather not take chances and turns down requests for her girls to do 'private group shoots'.

She cautions her models not to do so, especially when the shoot is in an 'in-house studio'.

One organiser, Ms Sophia Lin, 17, said there are a handful of photographers known to be touchy or overly friendly with models.

To ensure there is no hanky-panky, she is present throughout the shoots involving her models. She often has older friends in tow to help out as minders.

Some models are careful about the jobs they take. Popular model Celestina Tiew, 19, a student, said she works only with organisers who are her friends.

Asked if she fears the possibility of her photos being disseminated widely without her consent, she added: 'I don't sign a contract. But if you never do nude shoots, you won't have your pictures ending up in pornographic websites.'

She has turned down offers to pose in the nude because she is 'not daring enough'.

Ms Lin, who is waiting to enter a polytechnic, said organising shoots using models in the nude is out for her. But she observes that 'sometimes the girls will take off their bras and cover themselves with their hands or a towel'.

The distribution of obscene materials is prohibited under the Undesirable Publications Act.

The penalty is a fine not exceeding $10,000 or imprisonment for a term not exceeding two years or both.

Lawyers also caution that those working with models under 16 may risk running afoul of the Children and Young Persons Act.

Under this law, anyone found committing or abetting an obscene or indecent act with those under 16 can be fined up to $5,000, or jailed up to two years, or both.

$200/hour is a very good rate. $15/hour, not so good.

I suspect one reason why the age has been going down is because of the price. Younger usually means cheaper.

Suppose you get 3 models at $50/hour for 2 hours, that's $300. You need 6 people who are willing to pay $50 to break-even.

Several things that I lost over the years

I lost/misplaced a few things over the years. One of them is a CD. I like the CD and have bought it twice because I lost the CD the first time round. (It is my destiny to lose this CD.) Unfortunately, I don't remember its name nor the group, so I couldn't buy it again. Once, I heard a song from it over radio and even caught its name, but it slipped my mind just 5 minutes later!

If anything, I suspect I left the CD in my previous workplace. I left a box behind when I left my previous workplace. I remember this because I left one of my lens hood in the box and I wanted to get it back, but I never did. I will try to contact an ex-colleague to see the box is still there.

I also lost two Studio Ghibli DVDs: Kiki and Howl's Moving Castle. I couldn't find them when I wanted to rewatch them recently. I don't think I misplaced them because I couldn't find them in the usual places; I rarely put things out-of-place. I suspect I lent them out and forgot about them. I can be very careless sometimes. (But then, these are R2 DVDs from Japan. They are quite expensive. I thought I would be more careful with them.)

I will rebuy Kiki, but I'll wait for the Blu-ray edition that (i) is progressive, (ii) has no EE (edge enhancement) and (iii) has no window-boxing.

As for Howl's Moving Castle, I don't really like it. The story doesn't make much sense, just like Spirited Away. Many people don't dare to give poor reviews because of Hayao Miyazaki's fame, but I'll call a spade a spade. Personally, I think Miyazaki has lost it. His previous works, up to Princess Mononoke, are all very good.

To make matter worse, the R2 and R3 DVD versions of Spirited Away have a red tint. Studio Ghibli never admitted their mistake, but they must have used a monitor that was too bluish, that's why they made it so red.

To witness real Hayao Miyazaki magic, it is necessary to look at his earlier works:

- Castle of Cagliostro (1979)

- Nausicaa (1984)

- Laputa (1986)

- Totoro (1988)

- Kiki's Delivery Service (1989)

- Porco Rosso (1992)

- Princess Mononoke (1997)

Princess Mononoke is a very serious film, unlike his earlier works. It's very un-Miyazaki-like, if I should say so. It took me a second viewing to appreciate the show.

It is unfortunate most of the R2 DVDs have the same problems: (i) interlaced, (ii) EE and (iii) window-boxing. (Fortunately, the video can be reconstructed back to progressive easily, but the other two problems remain.)

A new Transformers toy

I'm an old-school Transformers fan. I only buy things related to the G1 (Generation One) series. These are the first three seasons of the TV cartoon and the movie — the real Transformers movie, not the Michael Bay who-the-hell-are-they sorry tale.

The only Transformers toys that I buy now are the Masterpiece series. I used to buy the Binaltech series, but not any more. They are well-engineered toys, but they are not canon.

I have MP-1 (Optimus Prime), MP-3 (Starscream), MP-5 (Megatron) and now MP-8 (Grimlock). I didn't buy the others because they are variants/repaints.

The Masterpiece toys are a solid piece of engineering. Hallmarks of the Masterpiece toys:

- Size (20cm to 30cm)

- Cartoon likeness in both forms

- Good articulation (posable)

- Gimmicks (lights, eye-color changes, accessories)

However, they also cost a lot. To ensure the sales volume, there are two important considerations: either the character is popular or it allows repaints. Starscream is a good example. The same mould was used for 2 other characters (MP-6 Skywrap, MP-7 Thundercracker).

The two leaders, Optimus Prime and Megatron, are the most popular characters. It's a no-brainer that the first toy out is Optimus Prime.

Megatron is a problem because of his gun mode. Realistic gun toys are not allowed in the US. Megatron was changed to a tank after G1, but to me, Megatron is always a gun. Takara didn't care and go ahead to produce him. Hasbro didn't license him for the US market.

Some people think the next Masterpiece would be Soundwave or Shockwave. That strikes me as unlikely because their transformations are very simple. In fact, I thought Grimlock was too simple to make into a Masterpiece.

I will continue to buy the Masterpiece toys, but I will not buy all of them. In fact, I'm biased towards not buying. I await the next toy eagerly because I want to see whether it changes my mind or not.

Expenses for March 2009

| Category | Jan | Feb | Mar |

|---|---|---|---|

| Basic | 1,061.55 | 985.02 | 2,574.12 |

| Cash | 213.60 | 241.50 | 172.10 |

| Vehicle | 258.35 | 307.97 | 577.60 |

| Others | 116.30 | 875.00 | 308.15 |

| Total | 1,649.80 | 2,409.49 | 3,631.97 |

Basic expenses are high due to an insurance premium.

Vehicle expenses are high because I changed the CB400F's tyres and related worn out parts ($365).

The bulk of other expenses are the tablet stylus ($138.03) and a slim lens filter for the 28/2 lens ($61.60).