The pedestrian overhead bridge to Dover was there before I was there, and it is still here, unchanged, after 31 years.

I used to cross this bridge pretty often, mostly to have dinner on the other side. Unfortunately, the housing estate on the other side had been demolished entirely. It is now empty land, but I believe it is zoned for educational institutes. That whole stretch is International schools.

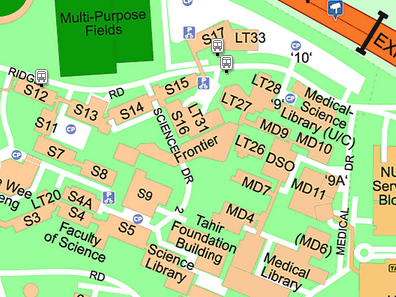

This map dates from 2010-ish and is how I remember it.

The Science 'campus' has changed a lot. Some parts remain the same, but some familiar landmarks are gone.

LT22, LT23, LT24 and LT25 are gone. I can't rem LT22, but I had attended lectures in the other Lecture Theatres.

CP7 and CP9 had disappeared. CP9 was a very 'hot' carpark. You need to come very early to get a spot. It is now a building. Although CP7 was a small carpark, I remembered it because I used to park my motorbike there and go to the canteen to tabao Claypot rice for my colleagues in the mid-2000s — I stopped when the store closed down.

Half the carpark is now occupied by a new structure they build to put air-con compressors for S14 (and perhaps other buildings). Many of the old blocks, e.g. S7, have large ugly metallic pipes running down the buildings. They look a bit Cyberpunk — industrial pipes on vintage buildings.

The canteen, now called Frontier, is much smaller than before.

I did not even know School of Computing has moved! SoC is no longer here.

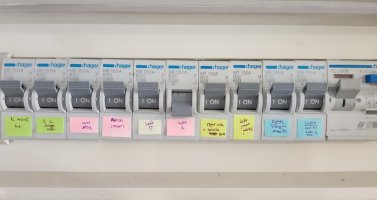

My DB box, same as before except type C is changed to type B. The Master room water heater is now used.

(The fifth MCB from the left is linked to the eighth MCB.)

20A smart switch for my water heater. There is another one for my air-con. I forgot to take a pic before it was blocked by the dryer.

When one FCU is in use, it uses 6.9 A. This is expected, the air-con catalogue already shows it. (It uses 7.0 A for two FCUs.) Because the compressor is non-inverter, it is either on or off, there is no variable speed. (The new air-con consumes 2 – 3 A when maintaining temperature.)

If it is on for the entire hour, it will consume 1.6 kWh, but it consumes around 1.2 kWh (based on smart meter reading), so its duty cycle is 75%. (*) A calculation shows its monthly usage is around 350 kWh! :horror:

(*) It depends on the ambient temperature. On a cool night (by Singapore's standard), the duty cycle may be only 40%.

The unexpected thing is that the air-con consumes 100 mA even when no FCUs are running. The app shows 12.8 W, half of VA — this is likely to be real power. This means 12.8 Wh or 0.3 kWh per day, or 9 kWh per month. It is not much, but it is not nothing. The new air-con and other appliances on standby consume 0.01 kWh per day at most.

As mentioned before, my compressor is on its last legs. When all FCUs are off but the compressor fan remains on, it consumes 750 mA. It is happening again.

The real surprise is my water heater. It trips the 20A smart switch — it shows a current of 21.5 A!

Upon reading the operating manual for the first time, I found that I have been using it wrongly since day one! The knob can only be set to four positions. I thought it was a variable thermostat. I set it to somewhere between II and III.

After using it correctly, 0 = 0 A, I = 5.9 A, II = 15.7 A and III = 21.3 A. III continues to trip the switch, but luckily II is sufficiently hot.

I'm not surprised if I had been running it at 21 A. No wonder I spoiled two of them... this is the third one. :horror:

I was lucky the wire held up! 21.5 A + dryer at 9 A, it was almost at the limit.

Missus ran the dryer and the plug is now only lukewarm. Previously it felt hot. To continue to monitor.

I got an electrician to do some rewiring and repairs. He came down twice, first to survey, second to do the works with his workers.

The Master room water heater circuit is routed to the water heater, so it is on its own 20A circuit. This is super easy. The trunking already exists, the only thing is to extend the wire from the bathroom to the service balcony.

(I feel the electrician overcharged me here, cos originally he thought he needed to drill a hole through the wall.)

The existing water heater switch remains, but it is changed to a Smart Control. This will allow me to monitor its power usage. As the Smart Control is touch-based and not a physical switch, I kept the Master room water heater switch. It must be kept on. Originally I wanted to bypass it.

The adjacent double power point is also changed as it is slightly burnt. Personally, I think it is perfectly usable.

To monitor if the dryer still overheats. If it does, will need to change to a heat pump dryer. They use less than half the power. Bad news: a heat pump dryer is expensive.

I also got the electrician to add a Smart Control to the existing air-con, above its 20A isolator switch. Again, this is to monitor its power usage.

For the spoilt light switches in the kitchen, one of them makes cracking sound, so it is replaced. Unfortunately, the electrician replaced it with a different model. I should have known. Electricians do not care about aesthetics. I could have bought a new one and replaced it on my own.

The other light switch is working, something else is broken downstream. The electrician said it is rare for light switches to spoil.

As this is connected to a LED power supply (a 12V 3A adapter), he said it was spoilt. But I had tested that the adapter works when attached to another light switch (the one with the cracking sound). Finally, he tested more thoroughly and found the cable connecting the power point to the adapter was spoilt.

I was rather surprised. A simple power cable can spoil? Two of them at that.

Funnily enough, when doing more testing, I attached an adapter to the light switch that was working and when I turned it on, I saw the power cable moved. It no longer worked.

So the situation now is that I have repaired the light switch, but have three spoilt power cables. Two adapters still work (tested with my monitor's power cable — I don't have any spare cables at home!), a third one cannot be removed from the cabinet for testing.

One adapter is making whining sound, so it is also not far from dying.

Not really, there are still more questions than answers.

The 20A CB that is not connected to anything? This is the easiest. It is connected to the common bathroom's instant water heater.

I recalled this when the electrician opened a blank panel outside the common bathroom and I told him it was for the old water heater. That was when I realized what the unused 20A CB was for. I vaguely remembered it controlled both instant heaters and the Master room switch was never used.

The electrician said my CBs are all type C except for two. He said all should be type B. Type B is used in residental homes and allows 2 – 3 times over-current. Type C is used in commerical places and allows 5 – 10 times over-current! Wah, doesn't this mean it will never trip?

I remembered wrongly about the linked 20A and 32A CB. Both must be off to turn off the circuit. If either is on, the circuit has power. The electrician verifies it again by checking every power point in the circuit.

According to the electrician, they should be two separate circuits, one for the living room and one for the rooms. But a previous electrician had combined them for some reason. There are two likely explanations:

He said will need to tear the whole circuit apart to find where they are linked, it is not worth the effort or cost, just use as-is.

I asked if I can turn on just one CB, he said to keep both on. I also asked if the limit is 20A, I got an unclear answer. He seemed to imply the limit is 52A (20A + 32A), but there is a 32A CB in the circuit, so it will trip first. I was thinking, shouldn't the 20A CB trip first?

When the electrician came down for the survey, he felt it was too difficult to lay a dedicated line due to my flat's layout and reno, so he suggested putting it off first.

I'm fine with the air-con using a shared circuit, just need to be careful using high power appliances — only iron (10A) — on this circuit.

After I remembered the unused common bathroom water heater, I wondered if it can be routed to the study room's air-con. It is quite near and I feel the existing trunking (both electrical and the unused parts of the old air-con piping) can be reused. But one of electrician's workers said it is not as easy as it looks. It is doable, but will need to drill some holes to pull the wire.

He then said it is in fact simpler to lay a new wire from the DB and put it in the fiber optic trunking — the same one that I wanted to conceal, but they won't touch it. The trunking already goes near the living room FCU. From there, will pass it through the same hole as the air-con piping to enter the study room.

The downside is that there will be extra trunking in the study room and the air-con power point needs to be moved.

They offered a discounted price if I agreed to do it on the same day. I thought for a while and ultimately declined.

The living room remains pretty neat. I like it. The problem is the extra trunking and new power point location in the study room. They are ugly.

I have not given up on a dedicated circuit for the air-con! I feel both ways are possible: route from common bathroom water heater, or lay a new wire from DB.

If laying a new wire from DB, it can reuse the fiber optic trunking, but it must go through the existing hole into the study room, reuse the existing trunking and the same power point.

I'm now inclined to keep the fiber optic trunking. It can be indistinguishable from the ceiling cornice if painted. But the places where it bridges the existing trunkings, hopefully they can be tided up.

I want to get to the bottom of the linked 20A and 32A CB eventually. The question is, how to find which power points are on each circuit and where they are joined?

Major changes to COE may be considered in the future, but for now the focus is on ERP 2.0, says the acting transport minister

A Certificate of Entitlement (COE) benefits more Singaporeans if given to a private-hire car (PHC) company than a private car owner, said Acting Transport Minister Jeffrey Siow.

In an interview with local media on Jun 11, he countered the idea that PHCs are “bidding up the prices of the COEs and therefore depriving Singaporeans of owning a car”.

As PHCs provide access to private transport on a pay-per-use basis, they drive down demand for COEs, he argued. Without PHCs to meet the needs for private transport, more people would want their own car.

“If you have one COE left to allocate, is it better… to give it to a private car owner who then drives maybe two trips a day and leaves the car in the garage, or is it better to share the car among a much larger group of Singaporeans who can have access to the use of a car when they need it? Surely it must be the latter, right?”

In the long term, Singapore could review the COE system as a way of allocating vehicles, he added.

“But my guess is that in the short term, there won’t be major tweaks.”

Asked how Singapore will continue to manage traffic congestion, Siow said the current focus is completing the roll-out of the Electronic Road Pricing (ERP) 2.0 system, while autonomous vehicles (AVs) could help in the longer term.

“I think the focus now is just sort of replacing (ERP 1.0), making sure that we get the replacement on track and (making) sure that every car is installed. As I said, that will take some time,” he said.

“After that, we can take a look at what to do in the next phase,” he added, without elaborating.

The first-generation gantry-based ERP system is being replaced with satellite-based ERP 2.0 that allows for distance-based charging. Around 500,000 vehicles have been fitted with the new system as at June 2025, and the roll-out is expected to be completed by 2026.

Last year, then-transport minister Chee Hong Tat said the authorities were open to a one-off increase in the total vehicle population, spread over a few years, with higher usage-based charges to prevent congestion – but such a move would need to be carefully studied.

In thinking about the next phase of private transport policy, the starting point is the need to limit the total vehicle population, said Siow.

Then the consideration is what to do “at the edges, at the margins… to adjust that top-line number”, he said.

AVs could be a “game changer” for private transport if they eventually present a good alternative to owning a car, similar to PHCs now, he noted.

The three stages of PHV-COE situation: denial, tweak, acceptance.

First, MOT (Ministry of Transport) denied that PHV caused COE price to be high. It was fairly obvious to everyone else.

Then, they tried to increase the monthly COE quota, but the little that they added was laughable.

Finally, now they say it is better to give COE to PHV as it will be better utilized.

Haven't we been down this road? Taxis used to be in cat A and caused cat A COE to be high. LTA finally removed taxis from cat A. So people asked if PHV could have its own category as well. This suggestion was rejected by LTA.

PHV and non-PHV are two different segments. PHV is commerical. Non-PHV is for personal non-monetizing use. As such, PHV can always outbid most of non-PHV because they have the means to recover the cost of high COE.

To PHC, a $100k COE may translate into daily rental of $130. $50k COE is $100/day. So PHC does not mind bidding up.

Mr Siow's statement that "they drive down demand for COEs" is simply false. If $100k COE is low demand, is he saying without PHC to 'depress' COE price, it would be $200k? No, COE was S$20k before PHC.

It is the same reasoning for motorbikes. Why does cat D COE hover stubbornly around $10k? Because it can be monetarized. Before this, cat D COE was less than $2k.

LTA does not have a lot of room to maneuver because Singapore has already hit 'peak car' population. There are around 600k cars in Singapore; roads are already extremely congested.

As indicated in the article, MOT is banking on two things: ERP 2.0 (distance-based charging) and autonomous vehicles.

Not all cars are the same. A car that travels 5k km a year vs one that travels 30k km a year, which one jams up the road more? This is the guiding principle behind 'low cost of car ownership, high cost of usage'.

(Singapore wanted to do it since ERP 1.0, but failed cos it does not dare to set high usage charges. The highest ERP charge is only $6.)

Public bus service is a prime candidate for AV. They have fixed routes and the main limitation to expanding a bus fleet is drivers. AV for feeder service makes sense as smaller buses can be used and frequency can be increased to improve last-mile connectivity. But AV is at least ten years away.

My Daikin air-con comes with the RC on the left. I have four of them. IIRC, they have light illuminating function, but it illuminates from one side only and becomes ineffective as the LCD darkens. One spoilt completely, so I have three left. This is the last to darken.

When the first RC failed, I went to TaoBao to buy a replacement. Most have Chinese labels, but there are English ones. I was not able to find the exact model, the closest I could find was the second from the left. It worked.

Later, I bought another unit to replace the ones with darkened display. I was not able to find the same replacement model, so I bought a similar one. Obviously the extra functions do nothing on my air-con. The clock drifts off very quickly on this model.

The RC on the right is from my Mitsubishi Electric Starmex air-con. Some differences:

Both brands can only use absolute time for timers. I wish they allow relative time, e.g. off in 2 hours.

The ME air-con manual recommends setting to Fan mode after Cool mode. This is to allow its inside to dry out. As such, it would be nice if the remote has such a quick setting: Fan mode at medium speed for 30 mins.

I bought a replacement RC for its backlight. I was tricked! The image shows even backlit illumination, the actual one is a single LED on one side!

The buttons are also stiffer and the up/down buttons are not glow-in-the-dark. There are also only 3 fan speeds instead of 4, but I knew that upfront. It is a waste of 26 yuan (S$4.65).

I'll continue to look for my ideal RC. It is not much:

Why do I want illuminated display? So that I can see the settings in the dark.

There is another way this can be done: by making the FCU beep differently at default settings. For example, the FCU can sound a different beep at these settings: cool mode, 24°C, auto-fan speed, auto-swing vane. The user can then use counting to get to the setting he wants. But UX designers today dislike this kind of 'advanced' usage. They are overwhelmingly visual oriented.